About

Chairman’s Message

Founded in 2007, Chartwell Capital was established with a simple mission in mind: to be your reliable and enterprising partner for undiscovered or overlooked investment opportunities in Asia. As the founder and CIO, my responsibility as a son, brother, husband and now father has evolved apace with our company’s transition from a family office into an asset management company. Members of the investment team that once served the family operation have become career-aspiring market participants, actively involved in the financial community.

In spite of our job titles changing during this transition, our responsibilities have not. We remain investment stewards, safeguarding our clients’ capital and seeking unbiased, intelligent, and profitable investment opportunities.

A commonly held belief is that Asia is high-risk. We beg to differ, and suggest that an economy is not equivalent to its financial market just as a company is not equivalent to its stock. They each have their own unique patterns with only occasional overlaps. From our viewpoint, risk relates to the quality of an investment, volatility relates to the characteristic of the investment, and return relates to the entry price of that investment.

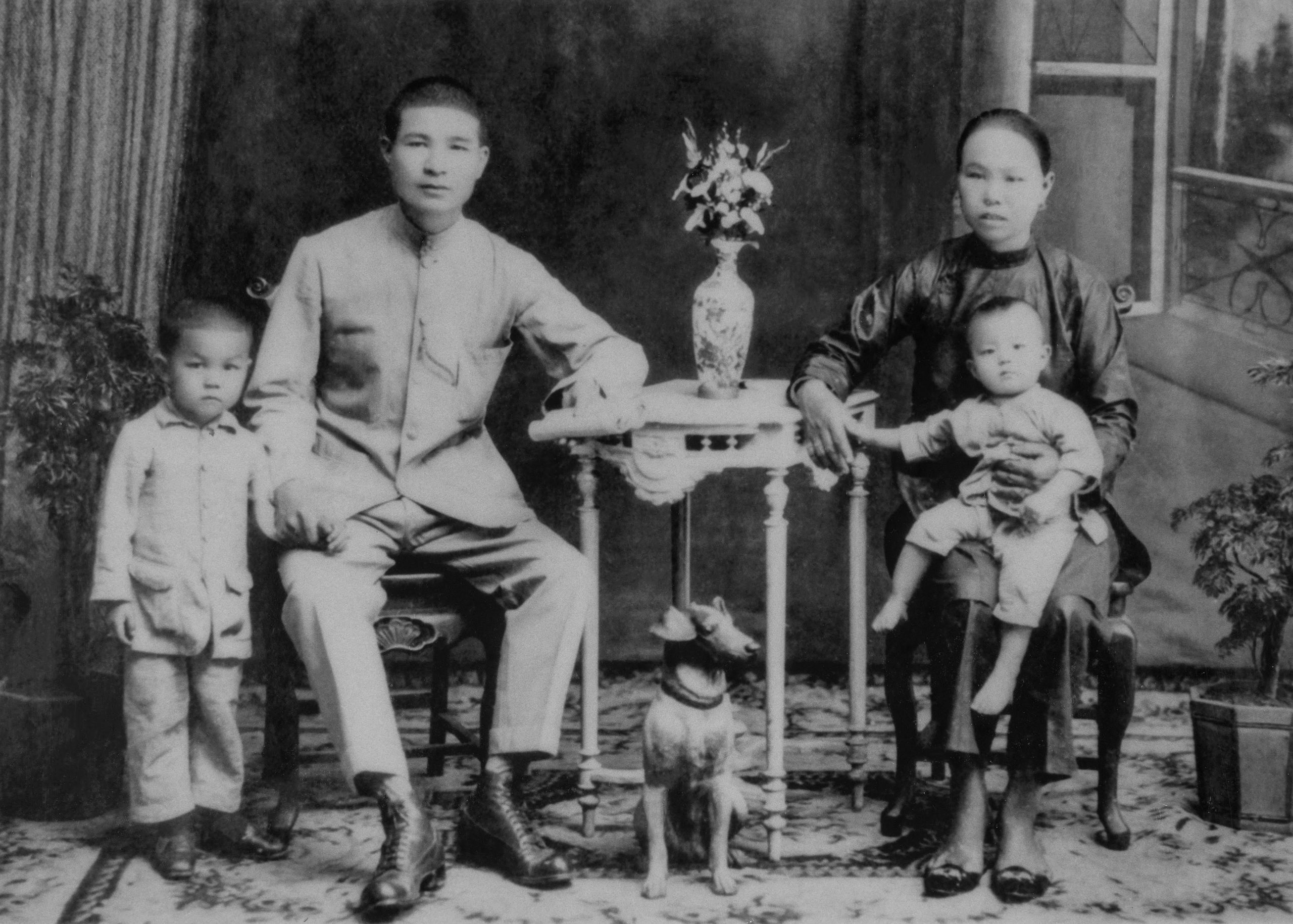

Ancestral photo of Chan family circa 1920

Asia can indeed be volatile, but many local businesses can be of low risk.

Chan speaking at the London Value Investor Conference

Don’t get me wrong, Asia can indeed be volatile, but many local businesses can be of low risk. Whether we can profit from them comes down to our entry point, which is determined by their price versus their intrinsic value. Our presence in the Greater Bay Area complements our strategy of focusing on undiscovered or overlooked quality companies in the region. By actively engaging in them, we only invest in them at the right price. The exercise albeit simple, is not easy. Financial numbers alone are not enough; an ability to stay ahead of the curve, accurately judge character, and draw upon our local knowledge and business networks serves as our guide.

We are on the lookout for like-minded investors to grow with us. We are as careful in our client selection as you are because our client partnerships are symbiotic. As Chartwell’s founder, I am committed financially to all our investments; our team also has a stake in them. Without an alignment of interests and similar investment horizons, we are unable to move forward together. After all, this is about building partnerships. We are not just investing for you, but with you.

Investing is not just a judgement of numbers, but also being a good judge of character.

We are aware of what we know, but oblivious to what we don’t know. So although we generate investment ideas internally, we still encourage frequent interactions with our clients as a means of stimulating new ideas. It is through this constant dialogue that we cultivate even stronger business networks and increase our collective investment intelligence.

Our inspiration for our firm’s name comes from Sir Winston Churchill, who reminds us that “success is not final. Failure is not fatal. It is the courage to continue that counts.” As we move forward together, our vision is to become your investment steward, providing proprietary market intelligence, network and investment solutions in the Asian business community.

Thank you.

Yours sincerely,

Ronald W. Chan